Brookfield Corporation’s 2025 Investor Day

For over 125 years, we’ve embraced change: anticipating it, adapting to it and turning it into opportunity. Today, we’re building on that foundation to drive transformative growth. Discover how below.

Watch the Highlights

Learn more about how we continue to grow our business with the same discipline and focus that define our success to date.

Key Takeaways

Our Evolution Continues

For more than 125 years, we’ve evolved with the global economy—rooted in our value-investing principles and deep operating expertise. Our consistent, disciplined investment approach to capital allocation approach allows us to identify secular trends, unlock opportunities and deliver long-term growth at scale.

We are in the midst of a transformative phase of growth, driven by three major trends. First, AI innovation is driving the need for massive infrastructure investment—a multi-decade opportunity where we are positioned to lead positioned to lead. Second, the retirement landscape is undergoing a fundamental shift, where aging populations are creating structural demand for new wealth products and services. And third, a global real estate recovery is underway, where those with scale and discipline—like Brookfield—will lead.

“Our history has been about understanding change and positioning ourselves to respond. ”

The Numbers Are Strong

We outperformed the targets we set five years ago and are positioned to carry that momentum forward.

Looking forward, we are positioned to keep building growth. That growth will come from two key areas: the first is participating in the growth delivered by our core businesses—asset management, wealth solutions, and our operating businesses. The second is the reinvestment of our excess cash flow. Together, these drivers, supported by a conservative balance sheet and strong liquidity, provide the platform for the franchise to deliver its evolution and continued growth.

"The foundations for growth are in place to continue the trajectory of growth."

Wealth is our Future

Using 100% of our own capital, we are building Brookfield Wealth Solutions into the preeminent global leader in wealth solutions built to compound value for decades.

This platform serves as the foundation of our investment-led insurance organization, built on Brookfield’s expertise in real assets and alternatives to deliver long-duration, predictable cash flows. With 100% of our own capital at work, we remain fully aligned with policyholders while positioning BWS to capture the most attractive global opportunities and compound value over the long term.

“Our investment-led approach has and will continue to create substantial value for shareholders. ”

Real Estate is in Recovery

Our high-quality portfolio is positioned to benefit as markets recover and fundamentals strengthen.

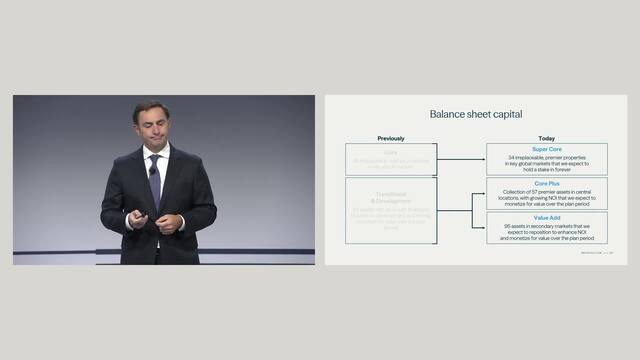

Our real estate business is built to perform across cycles, with a portfolio strategically anchored by Super Core, Core Plus, and Value Add assets—each delivering distinct value and growth opportunities. The office debate is settled: demand is accelerating, and our active management of high-quality centers continues to generate durable, long-term value. Looking ahead, our operational expertise positions us to drive sustained NOI and FFO growth while executing on asset monetization.

“Brookfield's real estate business is poised to take advantage of the clear real estate recovery that is underway.”

“Our disciplined investment philosophy has allowed us to deliver 19% annualized returns over 30+ years.”

CEO

Investor Day Clips

Related Views & News

Please refer to the Notice to Recipients contained in the Investor Day Presentation.