Overview

Our business performed well, with good progress across each of our core operations. Our asset management business had inflows of $25 billion and we added to our real asset credit franchise by agreeing to acquire a majority stake in an alternative private credit manager. Our operating businesses generated strong earnings, driven by their resilient cash flows, and we strengthened our capital, successfully financing over $30 billion of debt across our operations. Wealth solutions continued to deliver strong financial performance, and it received its regulatory license to launch in the U.K.—the first dedicated PRT license granted in the U.K. since 2007.

We advanced a number of important large-scale investments across the business, deploying $16 billion, and have an active pipeline. We monetized approximately $22 billion of assets, delivering strong risk-adjusted returns to our clients. We also increased the pace of our share buybacks in the quarter with the pull-back in the stock markets. To date this year, we acquired approximately $850 million of shares, adding intrinsic value to each remaining share.

While the geopolitical environment is more uncertain than three months ago, our focus remains the same: find great businesses to acquire, buy them when we can acquire for value, and operate them well once we own them. History has proven, through all economic conditions, that owning great businesses for long periods of time is the cornerstone of wealth creation.

Global Markets Were Volatile; Our Business Strong

We started the year with positive economic momentum. To date, growth and labor market data have remained resilient, but changes in U.S. trade policy have created uncertainty in capital markets. While our businesses and operations are not immune, they are generally insulated from the current environment. This is because our business focus is on providing essential products and services, which do not rely on the cross-border movement of goods; they serve customers locally and generally pass through increased input costs contractually to the end consumer.

As we have experienced in previous periods of stress, markets move for reasons that often don’t reflect underlying fundamentals. This creates opportunities for experienced, well-capitalized investors to invest for value. Regardless of how the current administration’s trade policy develops, the U.S. remains a premier destination for investment globally. It is energy independent, boasts the largest GDP in the world, has the deepest and most liquid capital markets, and is a leader in technology and entrepreneurship. The administration’s objectives focus on lower taxes, deregulation and industrialization, which on balance are positive from a long-term investment perspective. We will all get to the other side of this.

Staying the Course – Hold or Draw; Do Not Fold

Reflecting on periods of uncertainty over the last number of decades, we would like to offer our perspective on long-term investing. While it always feels like the first time in the moment, we have managed through many periods similar to the one we are seeing today. Our objective always remains the same: to create long-term value for our shareholders by buying, operating and owning businesses for long periods of time.

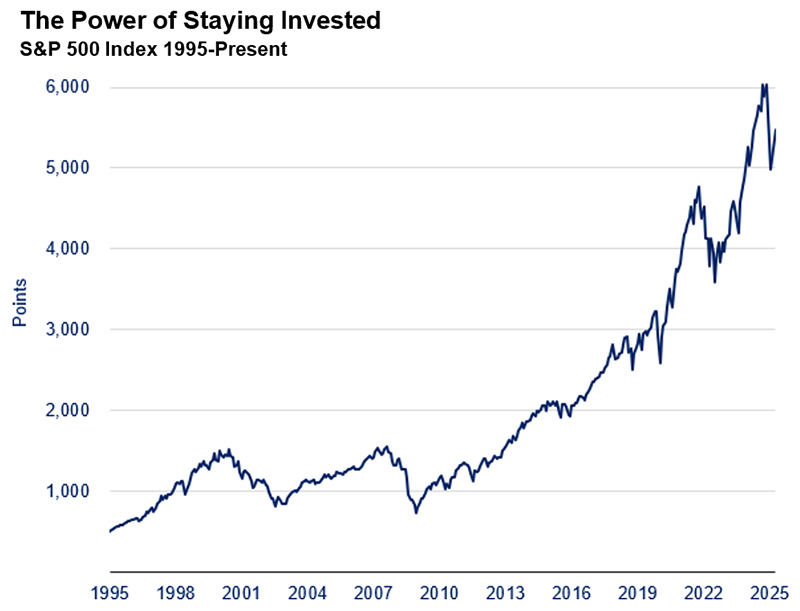

While price fluctuations in the moment seem significant, in the fullness of time they are likely to represent small deviations in the overall trajectory of the long-term compounding of wealth. Consider that the S&P 500 has delivered an annualized return of 10% over the past 30 years. Comparatively, our shareholders have earned an annualized return of 18% over that same 30 years by simply staying invested in Brookfield. Below is the S&P 500 chart over the past 30 years. Remember this next time you feel the urge to sell.

With a franchise that spans 30 countries, we have the operating expertise to navigate change. Our consistent investment and operating approach has allowed us to deliver stable and growing results for decades. This includes taking a measured approach to risk, focusing on execution over sentiment, and investing in the backbone of the global economy, especially in periods of greater uncertainty.

Crucial to this success over the years has also been the effective allocation and reinvestment of our free cash flow. We have a broad perspective on the relative investment opportunities and capital needs across our entire franchise. Our philosophy has always been to largely distribute out all free cash flow from our operating companies to the Corporation and to centralize cash flow reinvestment decisions. This approach becomes even more valuable during periods of uncertainty, when price can diverge substantially from value and we are presented with attractive value investment opportunities—not least repurchasing our own shares in the market. So far this year, we have capitalized on the market volatility to repurchase approximately $850 million of our shares at a significant discount to our view of intrinsic value. Warren Buffett articulated this point about capital allocation well:

“Charlie [Munger] and I mainly attend to capital allocation and the care and feeding of our key managers. Most of these managers are happiest when they are left alone to run their businesses, and that is customarily just how we leave them. That puts them in charge of all operating decisions and of dispatching the excess cash they generate to headquarters. By sending it to us, they don't get diverted by the various enticements that would come their way were they responsible for deploying the cash their businesses throw off. Furthermore, Charlie and I are exposed to a much wider range of possibilities for investing these funds than any of our managers could find in his or her own industry.”

This deliberate approach to capital allocation has been a key contributor to our ability to scale our business, and to withstand economic cycles across all the sectors in which we invest. This flexibility is one of our greatest strengths—and is something we created methodically and meticulously over many years.

Over the long term, price always meets value—market fluctuations are a natural part of the economic cycle, and the returns of a great business compound through all markets, good or bad.

Operating Results Were Strong and Should Continue to Be

Our first quarter financial results were strong. Each of our businesses continues to generate stable and growing cash flow. Each demonstrated resilience, supported by strong underlying fundamentals.

Financial Results

Distributable earnings (DE) before realizations were $1.3 billion, or $0.82 per share, in the quarter and $5.2 billion, or $3.26 per share, over the last 12 months. This represents an increase of 30% per share over the prior year quarter.

Asset Management – Our asset management business generated distributable earnings of $684 million, or $0.43 per share, in the quarter and $2.7 billion, or $1.71 per share, over the last 12 months. We raised $25 billion during the quarter, continuing our strong fundraising momentum. We closed on our flagship opportunistic credit strategy at $16 billion and held the final institutional close for the fifth vintage of our flagship opportunistic real estate strategy. We closed on $5.9 billion in the quarter in that strategy, increasing total capital raised to date to approximately $16 billion, already exceeding our goal. With the final close-out of clients in wealth and regional sleeves expected over the balance of the year, we are set to have by far our largest pool of capital for opportunistic real estate to date. We continue to see strong interest for our second global transition strategy and expect to hold the final close in the coming months. Fundraising helped drive fee-bearing capital to $549 billion, representing an increase of 20% from a year ago. Subsequent to quarter end, we announced the acquisition of a majority stake in Angel Oak, a leading origination platform and asset manager delivering innovative mortgage and consumer products with over $18 billion in assets under management.

Wealth Solutions – Our wealth solutions business generated distributable operating earnings of $430 million, or $0.27 per share, in the quarter and $1.5 billion, or $0.95 per share, over the last 12 months, benefiting from strong investment performance and the growth of the insurance asset base. We continue to build our insurance float by raising predictable, long-duration liabilities. During the quarter, we originated $4 billion of retail and institutional annuity sales, increasing insurance assets to $133 billion at quarter end. Leveraging the broader Brookfield ecosystem, we continue to gradually rotate the investment portfolio into higher quality investments and were able to generate an average investment portfolio yield of 5.7%, 1.8% higher than the average cost of funds, maintaining a 15% return on our invested capital. We anticipate increasing annualized earnings from approximately $1.7 billion today to $2 billion in the near term. Through our combined wealth solutions platforms, we are raising close to $2 billion of retail capital per month, which includes over $650 million a month from our private wealth channel.

Operating Businesses – Our operating businesses continue to deliver resilient and stable cash flows, generating distributable earnings of $426 million, or $0.27 per share, in the quarter and $1.7 billion, or $1.08 per share, over the last 12 months. Cash distributions from our renewable power and transition, infrastructure and private equity businesses were underpinned by their strong operating earnings. Additionally, in our North American residential business, we generated approximately $640 million of proceeds through the sale of master plan communities as we execute on our plan to shift the business to a more capital-light model. Our core real estate portfolio continues to benefit from increased demand for the highest-quality assets. Positive demand drivers are further supported by a muted supply outlook, contributing to higher occupancy and strong rental growth. As a result, we are seeing same-store NOI growth of 3% over the prior year quarter. We remain well- positioned to capitalize on these favorable market dynamics, which should drive sustained growth across our real estate portfolio.

Monetizations and Carried Interest – We continue to implement our investment business plans and value creation strategies. Accumulated unrealized carried interest increased by 14% over the last 12 months to $11.6 billion. As we execute on our monetization pipeline, we expect to realize much of this into income over the next five years. While uncertainty in the current environment may impact transaction activity, we continue to see strong demand for the globally diversified portfolio of high-quality, cash-generating assets and businesses we own. We closed approximately $22 billion of asset sales across the business in the quarter, with substantially all sales being completed at prices in line or above our carrying values.

In our infrastructure business, we completed the sale of a minority stake in a portfolio of fully contracted containers within our global intermodal logistics operation, and we sold two regulated natural gas transmission pipelines in Mexico. We agreed to sell the remaining 25% interest in NGPL, a U.S. gas pipeline. This closed out an extremely successful exit from the business, generating total gross proceeds of over $1.7 billion, crystallizing an 18% IRR and a 3x multiple of capital. We also agreed to sell a minority stake in a portfolio of operating sites from our European hyperscale data center platform for approximately $460 million, and are progressing the sale of an additional stake in the portfolio.

In our real estate business, we closed the previously announced sale of our luxury 360-key hotel and golf club in Florida. This transaction marked one of the largest single U.S. hospitality transactions in the last 12 months. We completed the sale of an office asset in Sydney, a portfolio of U.S. manufactured housing assets, and agreed to sell two shopping malls in Brazil for approximately $450 million. We also agreed to sell a logistics asset in Sydney for approximately A$330 million—the largest single-asset logistics transaction ever completed in Australia.

In our renewable power and transition business, we closed the sale of the first phase of our Indian solar and wind portfolio, as well as an electricity generation and storage facility in the U.K. We also reached an agreement to sell an additional 25% stake in one of our U.S. wind portfolios. In our private equity business, we sold the shuttle tanker segment of our offshore oil services operation.

As we execute monetizations and return capital to investors over the course of 2025 and beyond, we will be well-positioned to realize significant carried interest into earnings in the coming years.

Balance Sheet and Liquidity – We continue to maintain a conservatively capitalized balance sheet and high levels of liquidity. At quarter end, our perpetual capital base was approximately $170 billion, with a modest amount of long-dated corporate debt at the Corporation. This positions us well to capitalize on attractive growth opportunities, protects us from downside risks through market cycles, and enables us to continue to repurchase shares opportunistically. We executed on over $30 billion of financings across the business.

A few highlights include:

- The Corporation issued $500 million of 30-year senior unsecured notes, achieving its tightest 30-year spread to date. Similarly, Brookfield Renewable Partners issued C$450 million of medium-term notes during the quarter at its tightest new-issue spread in almost 20 years.

- In our private equity business, we completed an upfinancing at Clarios, our battery business, which funded a $4.5 billion special distribution to shareholders representing an approximate 1.5x realized multiple on our original investment, while retaining our entire share of the business.

- We issued €500 million of bonds at our German office REIT, a $360 million financing of a high-quality shopping center in the U.S., and approximately C$430 million of bonds on a core office asset in Canada.

- In our infrastructure business, we closed $885 million and $940 million of investment-grade asset-backed securities at our U.S. hyperscale and U.S. colocation data center businesses, respectively. These financings underscore the continued demand from lenders for digitalization opportunities.

Wealth Solutions Is Our “Newest” Engine of Growth

Five years ago, we established Brookfield Wealth Solutions (BWS). From the outset, our objective was building a business that can generate a durable 15%+ return on equity through economic cycles. Our goal is to source low-risk liabilities and earn our extra returns by drawing on our differentiated core competencies across real assets to invest a portion of the capital into real-asset credit and equity.

Real assets are ideal investments for insurance balance sheets because they generate long-term, inflation- protected cash flows. We have a unique capability in this area; our investment approach allows us to operate with conservative leverage and we have capitalized our insurance entities with more than $11 billion of equity capital. Our insurance operating companies are stronger and far better capitalized under our ownership than they were before, and we expect to build on this as we expand the business’ presence globally.

After growing through several acquisitions in the U.S. over the past few years, we are now beginning our international expansion. We were recently granted the first dedicated pension risk transfer license in the U.K.— the first such license to be granted since 2007—and plan to bring our strong track record of servicing policyholders to the region. With over £500 billion of corporate pension transfers to insurance companies expected over the next decade in the U.K., this represents a key market for continued growth.

One of our great advantages is our ability to leverage the Brookfield ecosystem, including our vast network for sourcing investment opportunities. We can offer our insurance pools access to transactions that are available to few other insurance companies. This includes acquiring investments in real assets, including real estate, to deliver attractive risk-adjusted returns through economic cycles to policyholders and our shareholders.

Real estate has been a widely held asset class across the insurance industry for many years, and the insurance companies we acquired already had a significant concentration of real estate in their investment portfolio. Our real estate business is one of the world’s highest-quality, largest and most established platforms, and as owners and operators over many decades, we have curated a portfolio of the best real estate assets around the world. These properties are premier assets in gateway cities and are exceptionally compatible with the long-dated nature of the insurance liabilities we manage on behalf of our policyholders. For these reasons, our intention is to slowly migrate some of these assets into BWS’ insurance accounts without materially impacting the overall allocation to real estate.

By rotating the incumbent real estate portfolio into a higher quality class of real estate, we are positioning our business for continued growth and attractive risk-adjusted earnings. As we execute our strategy it is important to note a few key points:

- Brookfield Wealth Solutions (NYSE: BNT, TSX: BNT) is a paired security to BN, meaning that both securities (BNT and BN) share the same underlying economic value—the value of overall Brookfield. This means that there is no winner or loser in any transactions done because the shareholders of BN and BNT share the same economic value. The tax profile for the shareholder is the only differentiating economic factor in owning one security or the other.

- For our insurance accounts, all transactions are subject to a robust review process—both internal and external, which includes conflicts committee approval, third-party pricing validation and regulatory oversight. Rest assured, we are building this business for the long term and therefore err on the side of conservatism in terms of pricing and process with our regulated accounts.

Our rigorous process ensures these transactions are always conducted with integrity and at arm’s length, and everything we do to strategically support the growth of our wealth solutions business reflects our long-term commitment to our policyholders.

Artificial Intelligence Is Here, But We Are Still in The Early Innings

Artificial intelligence (AI) is going to drive remarkable advancements in productivity, and we are just starting to witness its transformative impact. Based on the evolution of other technologies, we expect to see ever-increasing improvement in software and the application to robotics. Simply stated, this will make companies more productive, and while it is obvious that the major technology companies will be winners, the less obvious, real winners, will be those that apply these technologies wisely to everyday businesses.

As AI advances and becomes more efficient, companies will be able to introduce it at lower costs. Before long, we expect businesses will be able to create models tailored to their specific needs—and trained on their own data—to enhance many aspects of their operations. We are already leveraging the productivity benefits of AI within our portfolio companies, particularly in private equity, but this is just the beginning.

The U.S. is set to lead AI breakthroughs, supported by policies promoting the reshoring of key manufacturing, supply chains and technologies. These initiatives aim to secure America's technological edge and boost its economy, markets, and defense. Industrial businesses are investing heavily to reshore their manufacturing processes, reinforcing their domestic supply chains. We see many attractive opportunities for disciplined investors like us to continue providing much-needed capital to fund these initiatives.

These AI and related industrial opportunities won’t be limited to the United States. Countries around the world require sovereign AI and are looking to build many gigawatts of capacity to support their industries. France, for example, aims to be a data center leader in Europe, given its surplus of carbon-free nuclear power, and we have announced a €20 billion infrastructure investment program to support this buildout.

Digitalization remains a key driver of our infrastructure business’ current investment pipeline, with strong data center growth expected from both current and future use cases. A very large amount of capital is required to support this, and we are well positioned to be a leader in digitalization and AI infrastructure, while maintaining our consistent and disciplined investment approach.

The World Needs All the Power It Can Get

Market fundamentals remain exceptionally strong for power. Digitalization, reindustrialization and electrification are driving robust demand that far outpaces supply, favoring platforms of operational scale and diversification like ours.

The low cost of renewables, along with their ability to be deployed quickly in most markets, means that they continue to offer the most viable solution to meet growing energy demand. Despite recent weakness in market sentiment, we expect the significant supply-demand imbalance to help insulate industry leaders like us who are strategically positioned to expand our market position as power demand continues to rise.

While shifting U.S. policy does introduce some risk to the renewable power sector, it also presents significant opportunity. The new U.S. administration's actions to boost industrial, manufacturing, and data center activity are expected to increase electricity demand even more. We believe the growth prospects for low-cost, mature renewable technologies are stronger than ever, as they will play a crucial role in meeting these increasing generation capacity requirements.

As growing energy demand accelerates, development of energy storage solutions will be critical to ensure transmission availability and grid stability. This represents an attractive investment opportunity for investors of scale that have the ability to deliver comprehensive solutions to support the electrification of the global energy grid. The recent blackout in Spain and Portugal highlights the clear need for robust grid infrastructure and stability measures. We see large-scale battery energy storage systems and distributed generation as increasingly important parts of the solution—an area where we have been building and adding to our suite of capabilities.

The robust growth of our renewables pipeline is broad and includes projects driven by a “corporate pull” from global technology companies investing substantial capital in data center development to support digitalization and AI applications, as well as opportunities driven by the development of energy storage solutions aimed at supporting the electrification of the global grid.

As energy demand accelerates, the largest buyers of power will increasingly seek credible partners like us who have the operating expertise to secure their electricity needs. Our global team, capabilities and access to capital mean that we can deliver scalable solutions across technologies and regions few others can, and this reinforces our position as a partner of choice among all leading players in the sector.

In Conclusion

Over decades of operations, we have successfully navigated through many periods of uncertainty. We remain committed to our core competencies—investing in high-quality assets and businesses that compound strong cash returns on equity, while emphasizing downside protection for the capital employed. Our primary objective continues to be generating increased cash flows on a per share basis, thereby enhancing intrinsic value per share over the long term.

Thank you for your interest in Brookfield, and please do not hesitate to contact any of us should you have suggestions, questions, comments, or ideas you wish to share.

Sincerely,

Bruce Flatt

Chief Executive Officer

May 8, 2025

Cautionary Statement Regarding Forward-Looking Statements and Information

All references to “$” or “Dollars” are to U.S. Dollars. This letter to shareholders contains “forward-looking information” within the meaning of Canadian provincial securities laws and “forward-looking statements” within the meaning of the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and in any applicable Canadian securities regulations (collectively, “forward-looking statements”). Forward-looking statements include statements that are predictive in nature, depend upon or refer to future results, events or conditions, and include, but are not limited to, statements which reflect management’s current estimates, beliefs and assumptions regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, strategies, capital management and outlook of Brookfield Corporation and its subsidiaries, as well as the outlook for North American and international economies for the current fiscal year and subsequent periods, and which in turn are based on our experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. The estimates, beliefs and assumptions of Brookfield Corporation are inherently subject to significant business, economic, competitive and other uncertainties and contingencies regarding future events and as such, are subject to change. Forward-looking statements are typically identified by words such as “expect,” “anticipate,” “believe,” “foresee,” “could,” “estimate,” “goal,” “intend,” “plan,” “seek,” “strive,” “will,” “may” and “should” and similar expressions. In particular, the forward-looking statements contained in this letter include statements referring to the impact of current market or economic conditions on our business, the future state of the economy or the securities market, the anticipated allocation and deployment of our capital, our liquidity and ability to access and raise capital, our fundraising targets, our target growth objectives, and our target carried interest.

Although Brookfield Corporation believes that such forward-looking statements are based upon reasonable estimates, beliefs and assumptions, actual results may differ materially from the forward-looking statements. Factors that could cause actual results to differ materially from those contemplated or implied by forward-looking statements include, but are not limited to: (i) returns that are lower than target; (ii) the impact or unanticipated impact of general economic, political and market factors in the countries in which we do business; (iii) the behavior of financial markets, including fluctuations in interest and foreign exchange rates and heightened inflationary pressures; (iv) global equity and capital markets and the availability of equity and debt financing and refinancing within these markets; (v) strategic actions including acquisitions and dispositions; the ability to complete and effectively integrate acquisitions into existing operations and the ability to attain expected benefits; (vi) changes in accounting policies and methods used to report financial condition (including uncertainties associated with critical accounting assumptions and estimates); (vii) the ability to appropriately manage human capital; (viii) the effect of applying future accounting changes; (ix) business competition; (x) operational and reputational risks; (xi) technological change; (xii) changes in government regulation and legislation within the countries in which we operate; (xiii) governmental investigations and sanctions; (xiv) litigation; (xv) changes in tax laws; (xvi) ability to collect amounts owed; (xvii) catastrophic events, such as earthquakes, hurricanes and epidemics/pandemics; (xviii) the possible impact of international conflicts and other developments including terrorist acts and cyberterrorism; (xix) the introduction, withdrawal, success and timing of business initiatives and strategies; (xx) the failure of effective disclosure controls and procedures and internal controls over financial reporting and other risks; (xxi) health, safety and environmental risks; (xxii) the maintenance of adequate insurance coverage; (xxiii) the existence of information barriers between certain businesses within our asset management operations; (xxiv) risks specific to our business segments including asset management, wealth solutions, renewable power and transition, infrastructure, private equity, real estate and corporate activities; and (xxv) factors detailed from time to time in our documents filed with the securities regulators in Canada and the United States.

We caution that the foregoing list of important factors that may affect future results is not exhaustive and other factors could also adversely affect future results. Readers are urged to consider these risks, as well as other uncertainties, factors and assumptions carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements, which are based only on information available to us as of the date of this letter or such other date specified herein. Except as required by law, Brookfield Corporation undertakes no obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be as a result of new information, future events or otherwise.

Past performance is not indicative nor a guarantee of future results. There can be no assurance that comparable results will be achieved in the future, that future investments will be similar to historic investments discussed herein, that targeted returns, growth objectives, diversification or asset allocations will be met or that an investment strategy or investment objectives will be achieved (because of economic conditions, the availability of appropriate opportunities or otherwise).

Target returns and growth objectives set forth in this letter are for illustrative and informational purposes only and have been presented based on various assumptions made by Brookfield Corporation in relation to the investment strategies being pursued, any of which may prove to be incorrect. There can be no assurance that targeted returns or growth objectives will be achieved. Due to various risks, uncertainties and changes (including changes in economic, operational, political or other circumstances) beyond Brookfield Corporation’s control, the actual performance of the business could differ materially from the target returns and growth objectives set forth herein. In addition, industry experts may disagree with the assumptions used in presenting the target returns and growth objectives. No assurance, representation or warranty is made by any person that the target returns or growth objectives will be achieved, and undue reliance should not be put on them.

When we speak about our wealth solutions business or Brookfield Wealth Solutions, we are referring to Brookfield’s investments in this business that supported the acquisitions of its underlying operating subsidiaries.

Cautionary Statement Regarding the Use of Non-IFRS Measures

This letter to shareholders contains references to financial measures that are calculated and presented using methodologies other than in accordance with IFRS. These financial measures, which include Distributable Earnings (as defined below), its components and its per share equivalent, should not be considered as the sole measure of our performance and should not be considered in isolation from, or as a substitute for, similar financial measures calculated in accordance with IFRS. We caution readers that these non-IFRS financial measures or other financial metrics are not standardized under IFRS and may differ from the financial measures or other financial metrics disclosed by other businesses and, as a result, may not be comparable to similar measures presented by other issuers and entities.

We make reference to Distributable Earnings, which refers to the sum of distributable earnings from our asset management business, distributable operating earnings from our wealth solutions business, distributions received from our ownership of investments, realized carried interest and disposition gains from principal investments, net of preferred share dividends and equity-based compensation costs. We also make reference to Distributable Earnings before realizations, which refers to Distributable Earnings before realized carried interest and disposition gains from principal investments, and net operating income, which refers to the revenues from our operations less direct expenses before the impact of depreciation and amortization within our real estate business. Our outlook for growth in Distributable Earnings assumes growth in fee-related earnings and realized carried interest in line with our business plans, which assume growth in our fee bearing capital consistent with our fundraising plans, capital deployment expectations, maintaining the fee rates we earn on fee bearing capital and earning margins consistent with our current margin. Actual results may vary materially and are subject to market conditions and other factors and risks set out above. For more information on non-IFRS measures and other financial metrics, see Brookfield Corporation’s Q1 2025 Press Release, which includes reconciliations of these non-IFRS financial measures to their most directly comparable financial measures calculated and presented in accordance with IFRS.